MODULE 10: Making Homeownership Affordable

Making Homeownership Affordable

Making Homeownership Affordable

As we reflect on the different potential concerns or hesitations about homeownership, we know that we need to reassure tribal leaders and potential homeowners that homeownership options are affordable, and we are not encouraging tribal members to take on loans that they cannot repay over the long term. Recognizing that many tribal members have low incomes and there are limited employment options in many tribal communities, many question whether tribal members can afford homeownership.

How can tribal members afford to pay for a home?

While we acknowledge that homeownership and securing a mortgage loan is not for everyone, part of the answer to making homeownership affordable lies in looking carefully at what potential homeowners can afford to pay each month. As we started to see in our home design work, there are a number of strategies we can use to make homeownership more affordable.

What Can Homeowners Afford?

What Can Homeowners Afford?

As we look at affordability, let’s start by looking at what a sample family can afford. This sample is provided in Designing and Operating Homeownership Programs on Tribal Lands, which was prepared by the New Mexico Tribal Homeownership Coalition in partnership with the New Mexico Mortgage Finance Authority and Enterprise Community Partners.

Affordability Worksheet Samples

The following examples show how key information and a factor table are used to calculate an affordable monthly mortgage payment.

|

KEY INFORMATION |

|

|

Annual income |

$36,000 |

|

Monthly installment debt |

$500 |

|

Monthly insurance payment |

$30 |

|

Mortgage interest rate |

4% |

|

FACTOR TABLE |

|

|

Interest Rate |

30-Year Term |

|

3 |

4.21 |

|

4 |

4.77 |

|

5 |

5.37 |

|

6 |

6.00 |

|

7 |

6.55 |

|

8 |

7.34 |

How much can this family afford to pay each month?

|

LINE |

ITEM |

AMOUNT |

|

1 |

Annual household income of sample family |

$36,000 |

|

2 |

Family’s gross monthly income (LINE 1 ÷ 12) |

$3,000 |

|

3 |

Allowable monthly installment debt payments (LINE 2 X 0.41) |

$1,230 |

|

4 |

Existing monthly family installment debt |

$500 |

|

5 |

Available for Principal, Interest, and Insurance (PII) (LINE 3 - LINE 4) |

$730 |

|

6 |

Monthly insurance payment |

$30 |

|

7 |

Available for monthly principle and interest payment (LINE 5 - LINE 6) |

$700 |

What is a sustainable mortgage amount for this family?

|

LINE |

ITEM |

AMOUNT |

|

A |

Available for monthly principle and interest payment (from above) |

$700 |

|

B |

Payment factor (according to table for 4% interest rate) |

4.77 |

|

C |

Payment factor calculation (LINE A ÷ LINE B) |

$146.75 |

|

D |

Sustainable mortgage amount (LINE C X 1,000) |

$146,750* |

*This is only an estimate. This does not take into consideration lender fees and other costs to purchase a home.

What if the interest rate was lower (3%)?

|

LINE |

ITEM |

AMOUNT |

|

A |

Available for monthly principle and interest payment (from above) |

$700 |

|

B |

Payment factor (according to table for 3% interest rate) |

4.21 |

|

C |

Payment factor calculation (LINE A ÷ LINE B) |

$166.27 |

|

D |

Sustainable mortgage amount (LINE C X 1,000) |

$166,270 |

What if the interest rate was higher (8%)?

|

LINE |

ITEM |

AMOUNT |

|

A |

Available for monthly principle and interest payment (from above) |

$700 |

|

B |

Payment factor (according to table for 8% interest rate) |

7.34 |

|

C |

Payment factor calculation (LINE A ÷ LINE B) |

$95.37 |

|

D |

Sustainable mortgage amount (LINE C X 1,000) |

$95,370 |

What if the family had a down payment of $10,000?

|

LINE |

ITEM |

AMOUNT |

|

A |

Available for monthly principle and interest payment (from above) |

$700 |

|

B |

Payment factor (according to table for 8% interest rate) |

7.34 |

|

C |

Payment factor calculation (LINE A ÷ LINE B) |

$95.37 |

|

D |

Sustainable mortgage amount (LINE C X 1,000) |

$95,370 |

|

E |

Down payment |

$10,000 |

|

F |

Reduced mortgage amount |

$85,370 |

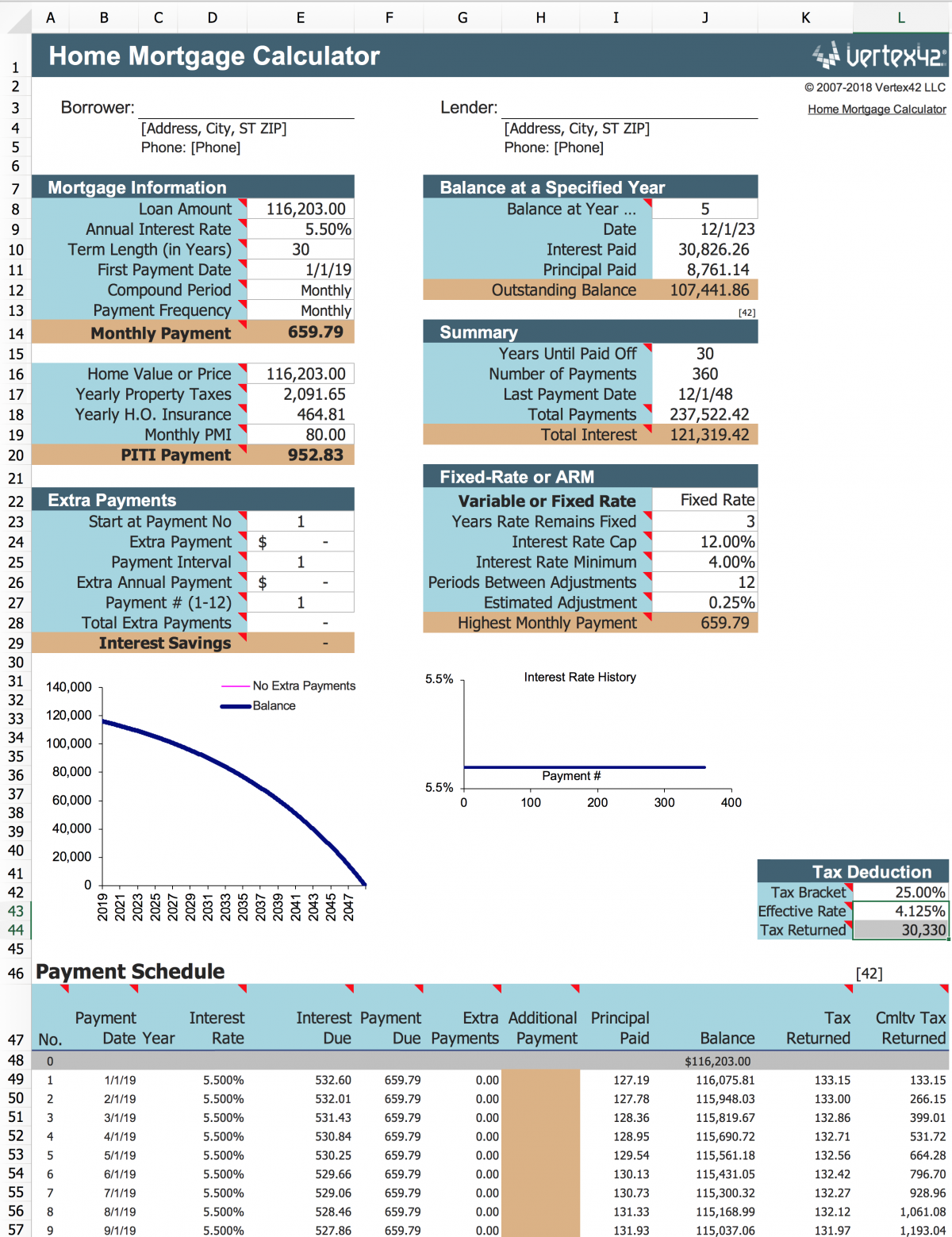

In looking at affordability, there are a number of helpful mortgage calculators that you can reference. The following page is a screenshot of a downloadable mortgage loan calculator provided by vertex42.com.

Affordability Worksheet Exercise

Affordability Worksheet Exercise

Use the key information and factor table below to calculate an affordable monthly mortgage payment for this family.

|

KEY INFORMATION |

|

|

Annual income |

$48,000 |

|

Monthly installment debt |

$425 |

|

Monthly insurance payment |

$35 |

|

Mortgage interest rate |

4% |

|

Down payment |

$5,000 |

|

FACTOR TABLE |

|

|

Interest Rate |

30-Year Term |

|

3 |

4.21 |

|

4 |

4.77 |

|

5 |

5.37 |

|

6 |

6.00 |

|

7 |

6.55 |

|

8 |

7.34 |

How much can this family afford to pay each month?

|

LINE |

ITEM |

AMOUNT |

|

1 |

Annual household income of sample family |

$ |

|

2 |

Family’s gross monthly income (LINE 1 ÷ 12) |

$ |

|

3 |

Allowable monthly installment debt payments (LINE 2 X 0.41) |

$ |

|

4 |

Existing monthly family installment debt |

$

|

|

5 |

Available for Principal, Interest, and Insurance (PII) (LINE 3 - LINE 4) |

$ |

|

6 |

Monthly insurance payment |

$ |

|

7 |

Available for monthly principle and interest payment |

$ |

What is a sustainable mortgage amount for this family?

|

LINE |

ITEM |

AMOUNT |

|

A |

Available for monthly principle and interest payment (from above) |

$ |

|

B |

Payment factor (according to table) |

$

|

|

C |

Payment factor calculation (LINE A ÷ LINE B) |

$ |

|

D |

Sustainable mortgage amount (LINE C X 1,000) |

$ |

|

E |

Down payment |

$

|

|

F |

Reduced mortgage amount (LINE D - LINE E) |

$ |

Ensuring Affordability

Once we have a sense of what families can afford, we can work to ensure affordability on two levels: the housing development/neighborhood level and the individual homebuyer level. Overall, our goal is to get the mortgage loan amount (and corresponding monthly payment) as low as possible. Let’s take a look at some strategies to make homes affordable on each level.

What are some housing development strategies to ensure that homeownership is affordable?

What are some strategies to ensure that homeownership is affordable at the individual homebuyer level?

In looking at affordability, we need to go back to home design and explore the use of different subsidies. We also need to outline all possible costs, to see what costs we can subsidize and what costs we can reduce.

STRATEGY #1: SUBSIDIZE INFRASTRUCTURE COSTS

In many rural tribal communities, we recognize that we are often working with raw land. Building homes also means providing infrastructure for new units, including roads, accessible paths, and utilities (water, wastewater, electrical, phone and/or broadband). There may be available funding sources to provide or cover some of these services and their costs, including:

-

◉Indian Health Service: may cover water/wastewater costs

-

◉USDA Rural Development: has funding for water/wastewater

-

◉Bureau of Indian Affairs: may be able to provide needed roads

-

◉Tribal Departments may have other funds for roads, data, etc.

STRATEGY #2: EXPLORE NEIGHBORHOOD DEVELOPMENT VS. SCATTERED SITE DEVELOPMENT

It will be helpful to develop cost comparisons to reflect the costs of subdivision vs. scattered site development, and the cost of each approach for individual homeowners. While some families may prefer to live on an individual site in a specific location, seeing the cost differences and how they could affect their mortgage and monthly payments may convince them to consider homeownership in a neighborhood.

STRATEGY #3: EXPLORE PRINCIPAL REDUCTION SUBSIDIES

Principle reduction subsidies are grant funds that reduce the overall mortgage amount, leading to lower monthly payments. For example, if home construction costs $150,000 and the borrower has a $20,000 principle reduction subsidy, the mortgage would be reduced to $130,000. Sources of principal reduction subsidies include:

-

◉ Federal Home Loan Bank (FHLB) – Affordable Housing Program (AHP)

The FHLB is organized by regions, and community organizations need to partner with a local FHLB member bank to apply. The application process is quite detailed.

-

◉ Housing Improvement Program (HIP) Funds

The Bureau of Indian Affairs (BIA) provides housing assistance support through its HIP program. While the program has traditionally assisted elderly and disabled tribal members, HIP funds may also be used for principal reduction subsidies.

-

◉ Tribal Funds

Some tribes have funds available to provide as principal subsidy grants for their own tribal members. Other tribes (with significant resources) may even be able to provide this support for homebuyers who are members of other tribes.

STRATEGY #4: EXPLORE DOWN PAYMENT AND CLOSING COST ASSISTANCE

Some mortgage loans require that borrowers pay a down payment or closing costs in cash when they close their loan. Different resources may be available to cover these costs, and like the principal subsidy reduction sources, accessing down payment and closing cost assistance can also make homeownership more affordable for tribal members. Some sources of down payment and closing cost assistance include:

-

◉ FHLB – Affordable Housing Program (AHP)

The FHLB is organized by regions, and community organizations need to partner with a local FHLB member bank to apply. The application process is quite detailed.

-

◉ FHLB – Native American Homeownership Initiative (NAHI)

Like the AHP, community organizations need to partner with a local FHLB member bank to apply for NAHI down payment funds. This program is only available in the Des Moines region of the FHLB.

-

◉ Housing Improvement Program (HIP) Funds

The Bureau of Indian Affairs provides housing assistance support through its HIP program. While the program has traditionally assisted elderly and disabled tribal members, HIP funds may also be used for down payment and closing cost assistance.

-

◉ Tribal Funds

Some tribes have funds available to provide as down payment and closing cost assistance for their own tribal members. Other tribes (with significant resources) may even be able to provide down payment and closing cost assistance for homebuyers who are members of other tribes.

-

◉ State Housing Agency Funds

Some states have funding available through the state housing agency for down payment and closing cost assistance. In South Dakota, for example, organizations may apply to the SD Housing Development Authority for Housing Opportunity Fund resources.

STRATEGY #5: LOOK AT AFFORDABLE HOME DESIGN OPTIONS

In working to ensure affordability for homeowners, design plays an important role, both in the short and long term. If you are designing new homes and developing new floor plans, it is important to work with an architectural design firm that understands and is committed to affordability. Looking at the short term, home design means looking at affordable materials and efficient layouts. Is space optimized? What materials will be used?

Design can also impact long-term maintenance and utility costs and health impacts on residents. Replacing a poor-quality roof every five years, for example, will result in significant costs for the homeowner over time, but may seem inexpensive at first compared to the initial cost of a high-quality roofing system. Working with a passive solar design, on the other hand, can mean lower heating costs in the winter (when the sun can warm up the house) and less cooling costs in the summer (when the sun’s rays are minimized) without adding substantial material costs. Active solar energy systems have significant initial costs, but they can save money over time as they reduce energy bills. Similarly, non-toxic and natural materials can cost more, although they will provide better health outcomes for inhabitants and may create more culturally responsive and attractive home environments too.

STRATEGY #6: LEVERAGE EXISTING FUNDING

In this strategy, we are using existing funding to attract additional funding to enlarge our pool of available funds. For example, rather than using $150,000 in Native American Housing and Self-Determination Act (NAHASDA) funding to build one home, we can provide 10 down payment grants of $15,000, which would lower the mortgage and enable homebuyers to access other mortgage funding.

STRATEGY #7: EXPLORE SWEAT EQUITY

Through “sweat equity” programs, homeowners or volunteers contribute labor to building the home, lowering the cost of construction. Habitat for Humanity promotes this method of construction, relying on volunteer labor, and USDA Rural Development promotes self-help construction through its 523 Program, which subsidizes the operational costs of self-help housing programs.

Sample Scenario: Is This Affordable?

Sample Scenario: Is This Affordable?

Now that we’ve looked at how to calculate what a potential homeowner can afford and explored different strategies to make homeownership more affordable, let’s take a sample scenario for one prospective homebuyer pursuing their dream home.

We’ll start with the home that your group designed in our previous module, verifying how much monthly payments would be. We’ll then take a look at a potential family and see how much they can afford in monthly house payments. If the loan amount appears to be more than they can afford, we’ll look at how we can lower these payments.

SAMPLE SCENARIO

The John Family

Pursuing Their Dream Home

The John family is interested in purchasing their dream home, which was recently designed by a group of experienced professionals. The cost to build the home is $_____________(fill in from Module 9). The Johns have four children and live in a rural, tribal community.

Mrs. John is currently a student and has a part-time job at the college. Her annual salary is $18,000. Mr. John works as a nurse with Indian Health Service. His annual salary is $45,000.

Looking at the John family’s current monthly debt payments, they are paying the following:

-

◉Truck payment: $450/month

-

◉Mr. John’s student loan payment: $100/month

-

◉JC Penney credit card: $25/month

The Johns can pay a down payment of $1,000, and homeowners’ insurance will be $45/month. Using the worksheet on the next page, answer the following questions:

-

◉At 4% interest, what are monthly loan payments for the home the Johns would like to purchase?

-

◉How much can the Johns afford to pay for housing each month?

-

◉Can they afford to purchase their dream home?

-

◉If they cannot afford their dream home, what subsidies would you recommend?

-

◉If you need to include infrastructure costs of $50,000, what would this do to the Johns’ monthly payment?

|

POSSIBLE SUBSIDIES FOR THE JOHN FAMILY |

|

|

FHLB NAHI subsidy |

$10,000 |

|

FHLB AHP subsidy |

$20,000 |

|

HIP down payment assistance |

$10,000 |

|

Tribal down payment assistance |

$25,000 |

|

FACTOR TABLE |

|

|

Interest Rate |

30-Year Term |

|

3 |

4.21 |

|

4 |

4.77 |

|

5 |

5.37 |

|

6 |

6.00 |

|

7 |

6.65 |

|

8 |

7.34 |

How much of a monthly mortgage payment can the John family afford?

|

LINE |

ITEM |

AMOUNT |

|

1 |

Annual household income of Mr. & Mrs. John |

$ |

|

2 |

Mr. & Mrs. John’s gross monthly income (LINE 1 ÷ 12) |

$ |

|

3 |

Allowable monthly installment debt payments (LINE 2 X 0.41) |

$ |

|

4 |

Existing monthly family installment debt |

$ |

|

5 |

Available for Principal, Interest, and Insurance (PII) (LINE 3 - LINE 4) |

$ |

|

6 |

Monthly insurance payment |

$ |

|

7 |

Available for monthly principle and interest payment (LINE 5 - LINE 6) |

$ |

What is a sustainable mortgage amount and home construction cost for the John family?

|

LINE |

ITEM |

AMOUNT |

|

A |

Available for monthly principle and interest payment (from above) |

$ |

|

B |

Payment factor (according to table) |

|

|

C |

Payment factor calculation (LINE A ÷ LINE B) |

$ |

|

D |

Sustainable mortgage amount (LINE C X 1,000) |

$ |

|

E |

Down payment |

$ |

|

F |

Affordable home construction cost (LINE D + LINE E) |

$ |

Can the John family afford their dream home without any subsidies?

How can you make the home affordable for the John family?

REFLECTIONS

-

◉What struck you in completing this affordability exercise?

-

◉Does ensuring affordability seem possible?

Partner Check

Partner Check

Are there additional partners that you'd like to add to your initial list?