MODULE 11: How Tribal Leaders Can Support Homeownership

How Tribal Leaders Can Support Homeownership

How Tribal Leaders Can Support Homeownership

Now that we’ve explored the key components of homeownership, we want to turn to the role and support of tribal leadership. This support is critical to the success of homeownership efforts, greatly increasing the likelihood of

providing Native homeownership opportunities. As we know, homeownership in tribal communities may require a pivot for tribal leadership and community members – a shift away from the “low rent” approach to a mortgage and repayment approach. Even when the Tribally Designated Housing Entity (TDHE) or another entity is taking the lead on providing homeownership opportunities, leadership plays a key role in realizing homeownership. In looking at the role of leadership, we want to explore:

-

How can we make the case to tribal leaders to support homeownership programs while addressing their concerns about such efforts?

-

What can tribal leaders do to support homeownership, both broadly and specifically?

Who Is a Tribal Leader?

Who Is a Tribal Leader?

In working in Native communities, we recognize that there are many types of tribal leaders, in addition to elected tribal council members. There are traditional leaders, elders, TDHE leaders, educational leaders, youth leaders, and grassroots leaders. In this discussion, we’ll be focusing on the governance role of elected tribal officials.

Making the Case

Making the Case

Often, in order to encourage tribal leaders to create the environment we need for homeownership, we need to make a strong case for homeownership – why does it make sense for tribal members in their community? Why should we make the shift from affordable rental opportunities to purchasing homes with mortgage products?

Making the case to tribal leaders – why should they support homeownership?

Homeownership provides secure shelter and helps address overcrowding.

-

◉By enabling families with incomes that can support a mortgage to move out of rental units, more units can become available for lower-income families.

Homeownership strengthens tribal sovereignty.

-

◉When tribal community leaders promote homeownership and enact laws to support it, they are exercising self-determination rights and self-governance. They are taking control and making decisions to improve the lives of tribal citizens.

Homeownership stimulates tribal economies.

-

◉Homeownership stimulates the residential construction industry, creating workforce development and employment opportunities in design, construction, maintenance, and related trades.

-

◉Homeownership stimulates the needs for related goods and services, keeping community dollars on the reservation.

-

◉Homeownership enables tribal members to live and work on the reservation, rather than commuting to border towns.

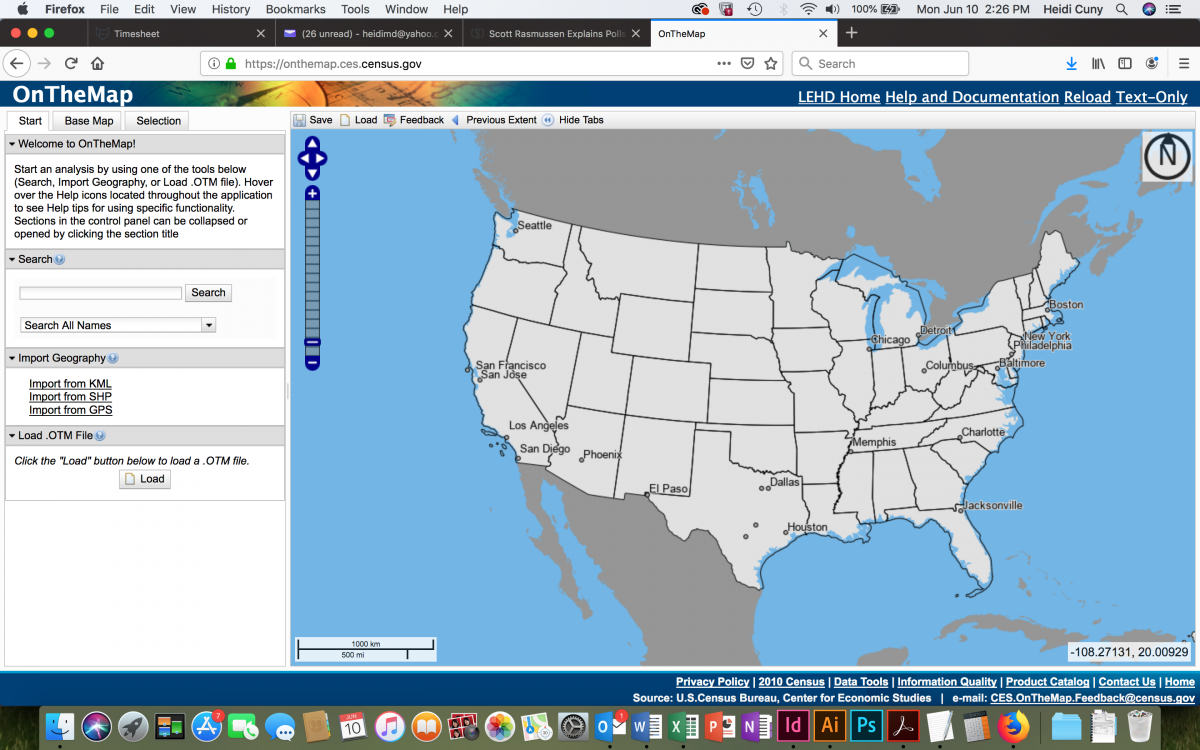

Census Bureau OnTheMap Tool

The Census Bureau’s OnTheMap Tool can help you understand reservation commuting patterns. Visit OnTheMap for information on how to use this tool.

The Census Bureau’s OnTheMap Tool can help you understand reservation commuting patterns. Visit OnTheMap for information on how to use this tool.

Homeownership promotes family stability and self-sufficiency.

-

◉Homeownership can provide the space for families to grow and enhance their economic opportunities.

-

◉Homebuyer and financial education classes enable families to build their budgeting and financial management skills.

-

◉Homeownership provides an important asset, and it enables families to build equity and increase their wealth.

Homeownership leverages scarce housing resources.

-

◉As families purchase homes with mortgages, affordable rental units become available, freeing up funding resources to assist families most in need.

-

◉Homeownership builds on tribal traditions.

-

◉Homeownership enables families to go back to their tribal traditions and build on traditional concepts of how tribal members once lived.

How Can We Address Tribal Leaders’ Concerns?

How Can We Address Tribal Leaders’ Concerns?

|

POTENTIAL CONCERNS |

RESPONSE |

|

Our families are very low income. |

It may be possible to look at affordable home design and access subsidies to lower the cost of the home. We also recognize that homeownership may not be the best fit for everyone. |

|

Families have credit issues. |

Homebuyer readiness programs can include developing credit repair plans and “credit builder loans.” The first step is running a credit report. |

|

There are no homes to buy. |

There may be local contractors able to build new homes, and TDHEs often have considerable construction experience. |

|

We don’t have funding to build new homes. |

It may be possible to access short-term construction funding, which can be repaid as families qualify for individual mortgages. |

|

Infrastructure is expensive. |

Different partners may be able to cover infrastructure costs, or provide infrastructure, such as Indian Health Service (IHS), Rural Development, and the Bureau of Indian Affairs (BIA). |

|

Families aren’t interested in homeownership. |

A needs assessment can play an important part in gathering data on families’ interest in homeownership and showing leadership that there is interest. |

What Do We Need Tribal Leaders to Do?

Once we’ve made the case, sharing why homeownership is important and addressing potential concerns, we need tribal leaders to support homeownership in two ways. First, we need tribal leaders to set the tone and create an environment that supports homeownership. Second, we need tribal leaders to carry out specific governmental functions that only leadership has the authority to conduct. Here, it is important for leadership to provide certainty for lenders, homebuyers, and other stakeholders involved in the home-buying and mortgage processes. Often, this means addressing lenders’ concerns and putting pieces in place that make lenders more comfortable with the process in Indian Country. Let’s take a look at these two types of support.

How can tribal leaders set the tone, and create an environment that fosters a vibrant mortgage and residential construction market within their communities so there are more homeownership opportunities for tribal members?

-

◉Identify a lead entity.

-

◉Allocate financial resources for down payment assistance and other homeownership needs.

-

◉Pay living wages to tribal employees.

-

◉Model fiscally responsible behavior.

-

◉Support the homeownership application process for tribal employees and provide timely responses to requests for Verifications of Employment.

-

◉Provide support for financial and homebuyer education courses and participate in the classes.

-

◉Develop relationships with lenders.

-

◉Invest in a Native community development financial institution (CDFI) serving the community.

-

◉Recruit insurance providers, appraisers, inspectors, and contractors.

-

◉Encourage tribal citizens to become residential construction professionals.

-

◉Encourage the TDHE to develop a “culture of payment,” which includes reducing TARs (Tenant Account Receivables) and charging market-rate rents.

-

◉Encourage TDHEs to identify tenants who are bumping up against the 30% income limits for rental eligibility to explore homeownership.

-

◉Be proactive in tying homeownership and economic development.

How can tribal leaders address lenders’ concerns and put pieces in place that make lenders more comfortable? (Please note many of these will not apply to communities in Alaska.)

-

◉Enact legal codes. As sovereign nations, tribal governments may need to enact their own codes to govern the residential construction and mortgage processes on tribal land. This may include mortgage, foreclosure, and residential building codes. These laws must be institutionalized and should not change when a new tribal administration comes into office. Tribal communities may also elect to adapt such frameworks to account for cultural factors or lifeways. For example, a community could adopt the International Building Code, but adapt it to include traditional building methods and materials.

-

◉Identify a clear path for civil claims involving mortgage foreclosure and eviction. It is critical for tribal governments to have court systems in place, free from political interference, that provide a mechanism for laws to be enforced and a venue for all parties to seek legal remedies.

-

◉ Negotiate with federal and state agencies, private lenders, and investors to access government and conventional loan programs. To provide the authority for certain lenders to do business in a tribal jurisdiction, tribal governments may need to enter into agreements with those lenders. To make the full range of public and private mortgage loan products available to their citizens, tribal leaders should seek to enter into those agreements and negotiate terms that recognize the tribe’s sovereignty, consider the interests of the borrowers, and address the requirements and concerns of the lenders.

For example, in order to offer conventional mortgage loans that can be sold on the secondary market, secondary market investors (Fannie Mae, Freddie Mac, and Ginnie Mae) require the tribe to enter into a Memorandum of Understanding (MOU). This MOU outlines the ordinances, codes, and systems that need to be in place in order for the investors to purchase loans made in that tribal jurisdiction.

-

◉Define the tribe’s role in the event of a mortgage delinquency, default, foreclosure, and/ or eviction. On trust land, addressing delinquencies, defaults, foreclosures, and evictions can become a lengthy, complicated, and costly process for lenders and borrowers. Some tribes are taking an active role in helping to minimize delinquencies and prevent defaults and foreclosures in their communities.

-

◉ For example, tribes may negotiate a “right of first refusal” to purchase the property in the case of a default.

-

◉ A tribe or its housing department may help to find another family member who meets the loan qualification requirements to move into the house and take over mortgage payments, so an outsider is not moving into the community.

-

◉ If another qualified borrower is not identified, the tribe may decide to purchase the home to add to its own housing inventory, rather than allow the home to remain vacant and potentially become vandalized and the site of criminal activity.

-

-

◉Develop a land management program that supports the mortgage process. It is easier for individual homebuyers and other builders to construct new homeownership units when tribal leaders have undertaken comprehensive land-use planning that maps out residential, agricultural, and commercial zoning; transportation planning; and physical infrastructure, such as water, sewer, and other utilities. In addition, mortgage-based homeownership has become even more accessible where tribal land departments have implemented an expedited, streamlined leasing process.

Tying Homeownership Education to Civic Engagement

Tying Homeownership Education to Civic Engagement

An important part of empowering tribal citizens to improve their financial capability is to help them to understand how their financial opportunities are impacted by elected tribal officials’ actions. For example, if tribal leaders fail to enact or enforce laws that govern the mortgage lending process, then mortgage financing may be difficult for tribal citizens to obtain. Homebuyers in Native communities have the power to influence this process through their civic engagement in electing tribal leadership.

Consider expanding your homebuyer readiness services to include a lesson on civic engagement and the practice of electing tribal officials based on their understanding of how their governance role can support mortgage financing and other economic growth opportunities.

Assessing Tribal Leadership Support

Assessing Tribal Leadership Support

Use the chart below to assess the tribal leadership support of homeownership in your community.

|

QUESTION |

ANSWER |

||

|

Does tribal leadership understand and support homeownership? |

☐ Absolutely |

☐ No Way |

☐ Have No Idea |

|

Has tribal leadership identified a lead entity to spear- head homeownership efforts? If yes, who? |

☐ Absolutely |

☐ No Way |

☐ Have No Idea |

|

Has leadership allocated financial resources to support homeownership, such as down payment assistance? |

☐ Absolutely |

☐ No Way |

☐ Have No Idea |

|

Does tribal leadership support financial and homebuyer education courses? |

☐ Absolutely |

☐ No Way |

☐ Have No Idea |

|

Does tribal leadership have relationships with lenders? |

☐ Absolutely |

☐ No Way |

☐ Have No Idea |

|

Is tribal leadership investing in a Native CDFI serving the community? Or open to initiating a CDFI? |

☐ Absolutely |

☐ No Way |

☐ Have No Idea |

|

Does tribal leadership encourage tribal citizens to become residential construction professionals? |

☐ Absolutely |

☐ No Way |

☐ Have No Idea |

|

Is tribal leadership recruiting insurance providers, appraisers, inspectors, and contractors? |

☐ Absolutely |

☐ No Way |

☐ Have No Idea |

|

Do tribal leaders understand how homeownership improves the social and economic health of their community? |

☐ Absolutely |

☐ No Way |

☐ Have No Idea |

|

Does the tribe have a leasing process in place and a strong relationship with the BIA? |

☐ Absolutely |

☐ No Way |

☐ Have No Idea |

|

Does the tribe have mortgage and foreclosure codes? |

☐ Absolutely |

☐ No Way |

☐ Have No Idea |

|

Does the tribe have court systems in place that provide a mechanism for law to be enforced and a venue for all parties to seek legal remedies? |

☐ Absolutely |

☐ No Way |

☐ Have No Idea |

|

Does the tribe have agreements in place with lenders? |

☐ Absolutely |

☐ No Way |

☐ Have No Idea |

|

Does the tribe have a system in place to deal with foreclosures (such as a plan to find another qualified tribal family to move into the home and take over on mortgage payments)? |

☐ Absolutely |

☐ No Way |

☐ Have No Idea |

Role Play: Making the Pitch to Tribal Council

Role Play: Making the Pitch to Tribal Council

Activity Guidelines

-

Determine roles – who will play Tribal Council members (5-6 participants) and who will play the tribal members (2-4) who are making the pitch?

-

Determine what you’ll be asking Council to do (this can be based on your assessment of what’s needed in your community):

-

Outline the key points focusing on why Council should support homeownership:

-

Outline some potential concerns that Council members may have about homeownership and how these can be addressed:

CONCERN

HOW TO ADDRESS

- - - - - - -

Practice role playing using the materials you’ve developed.