MODULE 7: Lending Processes and Loan Products to Optimize Homeownership

Lending Processes and Loan Products to Optimize Homeownership

Mortgage lending lies at the heart of homeownership. Typically, off reservation, the lender provides a mortgage loan to the homebuyer to enable them to purchase a home. The collateral for this loan is the house and the land, so if the borrower fails to make payments, the lender has the right to the house and the land. The mortgage process is different on trust land, since the land cannot be used as collateral. On trust land, the lender takes a leasehold mortgage, where the collateral for the loan is the house and the interest in the land, rather than the land itself beneath the house.

In this module, we’ll take a look at the overall lending process, and then hone in on two important pieces of lending on trust land – the secondary market and the role of community development financial institutions. Then, we’ll turn to specific mortgage products.

Overview of the Lending Process

Overview of the Lending Process

Building on our examination of the leasehold mortgage process in Module 3, let’s take a look at the overall lending process. More detailed information on this process can be found on pages 69-70 of the Tribal Leaders Handbook on Homeownership.

Secondary Market

Secondary Market

Secondary market investors purchase loans from lenders. This makes lending more attractive to the lenders, since they can recapture loan capital and relend it to other borrowers.

The major secondary market investors are Fannie Mae, Freddie Mac, and Ginnie Mae. In order to offer conventional mortgage loans that can be sold on the secondary market, these investors require the tribe to enter into a Memorandum of Understanding (MOU). This MOU outlines the ordinances, codes, and systems that need to be in place in order for the investors to purchase loans made in that tribal jurisdiction.

Ginnie Mae purchases government-guaranteed or subsidized loans, including HUD Section 184 loans. Fannie Mae and Freddie Mac purchase conventional and government loans. While they were active in Indian Country through the early 1990’s, secondary market investors stopped activity during the U.S. mortgage crisis, when they were placed by the government into conservatorship because of their weakened financial position.

Currently, as part of being under conservatorship, Freddie Mac and Fannie Mae are required to develop Duty to Serve plans, which outline how they will provide a secondary market for very low-, low-, and moderate-income families by focusing on manufactured housing, rural areas, and housing preservation.

This short video provides more information on the Duty to Serve program.

Community Development Financial Institutions (CDFIs)

Community Development Financial Institutions (CDFIs)

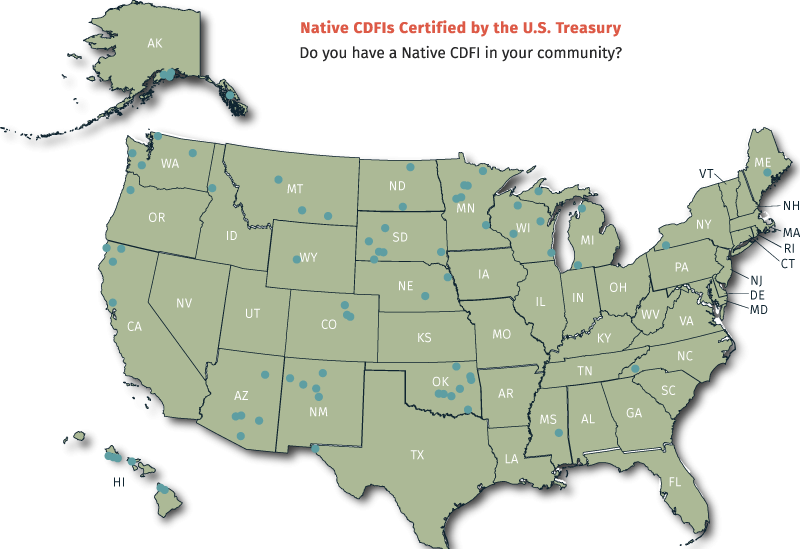

CDFIs are community-based lenders created to meet the financial needs of community members. Often, CDFIs operate in areas not served by other lenders. There are currently over 70 Native CDFIs certified by the U.S. Treasury Department. These CDFIs can function as loan funds, banks, bank holding companies, credit unions, and/or venture capital funds. While many of these Native CDFIs focus on entrepreneurship and business lending, a number of Native CDFIs have developed mortgage loan products and are showing private lenders that mortgage lending on trust land is possible. (See case study on pages 72-76 of the Tribal Leaders Handbook on Homeownership.)

Overview of Loan Products Available for Native American Homebuyers

Overview of Loan Products Available for Native American Homebuyers

Now, let’s take a look at the different mortgage products accessible to Native American borrowers on trust land. There are basically three types of loan products:

-

◉Direct loans are originated by a government agency directly to a borrower, such as the USDA Rural Development 502 Direct Loan or Veterans Affairs (VA) Native American Direct Loan. In this case, the government is the lender.

-

◉Guaranteed loans are originated by a private lender but guaranteed by a government agency, such as the U.S. Department of Housing and Urban development (HUD) Section 184 or USDA- guaranteed loan. In this case, the government is the not the lender but often sets strict guidelines that the private lender must follow to participate in the program.

-

◉Conventional loans are originated by a private lender and are often sold to secondary market investors, such as Fannie Mae, Freddie Mac, or Ginnie Mae. These private loan products have certain requirements set by the investor. If the lender does not follow the requirements, the loans cannot be sold and must be held in the lender’s portfolio. Or if the circumstances change and the loan no longer conforms to the requirements, then the lender may have to repurchase the loan from the investor.

It is important to note that we typically see less conventional loans on trust land than direct or guaranteed loans, since private lenders are often hesitant to originate mortgages on trust land because of concerns about collateral and risk.

In looking at these different mortgage products and programs, it is important to analyze and compare available loan products to determine which option is best for a particular borrower. A more detailed matrix of loan products is provided on pages 132-37 of the Tribal Leaders Handbook on Homeownership.

USDA Rural Development 502 Guaranteed Home Loan

This loan targets low- and very low-income families in rural areas around the country. The loans may be made on trust land, and interest rates are calculated based on family income (going as low as 1%.) USDA guarantees this loan, which is made in partnership with a local lender.

USDA Rural Development 502 Direct Home Loan

This loan targets low- and very low-income families in rural areas around the country. The loans may be made on trust land, and interest rates are calculated based on family income (going as low as 1%). USDA originates the direct loan product.

HUD Section 184 Indian Home Loan

Through this product, HUD provides a 100% guarantee for loans made by private lenders and mortgage companies to qualified, eligible Native American homebuyers, tribes, and Tribally Designated Housing Entities (TDHEs) for one to four units of housing located in eligible tribal areas. This product has no minimum or maximum income limits, requires a low down payment, and considers alternative credit histories in the underwriting process.

HUD Section 184A Indian Home Loan

This is HUD’s loan guarantee program for use on Hawaiian home lands. Through this program, HUD guarantees loans made by private lenders for the purchase of single family dwellings on Hawaiian home lands.

VA Native American Direct Loan

The U.S. Department of Veterans Affairs originates this loan to qualified Native American veterans. Interest rates are calculated based on income and may go as low as 1%. (Note: This loan product is not available to Native American veterans in Alaska.)

Federal Housing Administration (FHA) Section 247

Through this program, FHA insures loans by conventional lenders to Native Hawaiians to purchase one to four family dwellings located on Hawaiian home lands.

Fannie Mae HomeReady(Affordable Product) and Fannie Mae Conventional

Fannie Mae offers a range of loan products targeting low- and moderate-income and underserved borrowers. For a Fannie Mae-approved lender to be able to originate these loans for home purchase on trust land, a Memorandum of Understanding (MOU) must be in place between the tribe and Fannie Mae. The MOU outlines the mortgage lending process in that jurisdiction, including what happens in the event of delinquency, default, or foreclosure. There are a number of differences between the two products, including income eligibility and homebuyer education requirements.

The Role of Tribal Leadership in Mortgage Lending

The Role of Tribal Leadership in Mortgage Lending

Regardless of the type of loan product selected, tribal leaders have an important role to play in the smooth implementation of the lending process.

-

◉Practitioners should work closely with their tribal leadership to encourage them to exercise tribal sovereignty and ensure that the lending process in their jurisdiction benefits their Native community.

-

◉The process should meet the requirements of the lenders and loan programs and give homebuyers the best chance for success possible. For example, tribal decision-makers should take the steps necessary to ensure that tribes and TDHEs receive notice as early as possible in the event of default (nonpayment) in order to avoid foreclosure.

-

◉Also, the tribe or TDHE should have the authority to exercise a right of first refusal to purchase a unit from a family that can no longer pay their mortgage. The tribe or TDHE could resell it to another homebuyer or add the home to their rental housing inventory.

-

◉Active engagement of tribal leadership throughout the loan process can help to avoid foreclosures and vacant homes within Native communities.

We will discuss the role of tribal leadership further in Module 11.

Game Show Activity

Game Show Activity

Now, we’ll review what we know about the different loan products, the lending process, and foreclosure prevention through a game show.

|

Federal Agencies

|

Secondary Market

|

Loan Products

|

Miscellaneous

|

|---|---|---|---|

|

$100

The NADL is approved by this government agency

What is the US Department of Veterans Affairs?

|

$100

One of the main secondary market investors

What is Fannie Mae or Freddie Mac?

|

$100

The loan approved by the Department of Veterans Affairs for Native veterans.

What is NADL?

|

$100

These are alternative lenders providing capital in underserved communities.

What are CDFIs?

|

|

$200

This federal agency originates the 502 loan.

What is USDA Rural Development?

|

$200

In order for Fannie Mae to work with a tribe, this must be in place.

What is a Memorandum of Understanding?

|

$200

HUD guarantees this loan, made by private lenders.

What is Section 184 Loan?

|

$200

The 502 is targeted to these types of rural borrowers.

What is Low- or very low- income?

|

|

$500

This federal agency that guarantees the 184 loan product.

What is HUD?

|

$500

Another secondary market lender.

What is Fannie Mae or Freddie Mac?

|

$500

USDA’s loan for low income, rural borrowers.

What is the 502 Loan?

|

$500

The USDA 502 direct loan can go down to this percentage of interest.

What is 1%?

|

|

$1000

This agency plays an important role in leasehold mortgages on trust land, approving leases and issuing clear title.

What is Bureau of Indian Affairs?

|

$1000

The secondary market lenders must develop this kind of plan.

What is Duty to Serve?

|

$1000

Fannie Mae’s affordable home loan product.

What is the FannieMae HomeReady loan?

|

$1000

A loan that a government agency makes directly to the borrower.

What is a Direct Loan?

|

Partner Check

Are there additional partners that you'd like to add to your initial list?